As enterprises embrace Web3 technologies, the transformation of physical commodities and real-world assets (RWAs) into digital assets is revolutionizing industries across the globe. Tokenization has become the catalyst driving this shift, enabling a new era of investment and asset management. The 2025 Skynet RWA Security Report projects that the market for tokenized real-world assets could climb to $16 trillion by 2030. The report highlights that tokenized U.S. Treasuries are already expanding quickly, expected to hit $4.2 billion in 2025, with the majority tied to short-term government bonds. Tokenization is reshaping markets, especially in the context of art, real estate, and commodities, and what it means for the future.

The Evolution of RWAs

Historically, commodities like gold, real estate, and fine art were considered exclusive, physical assets that symbolized wealth and stability. Owning land or a precious metal was once a marker of financial security. However, as we enter the digital age, these commodities are undergoing a transformation. They are now being tokenized—digitized and represented as blockchain-based assets. This change not only makes RWAs more accessible but also adds layers of transparency and security.

What Is Tokenization?

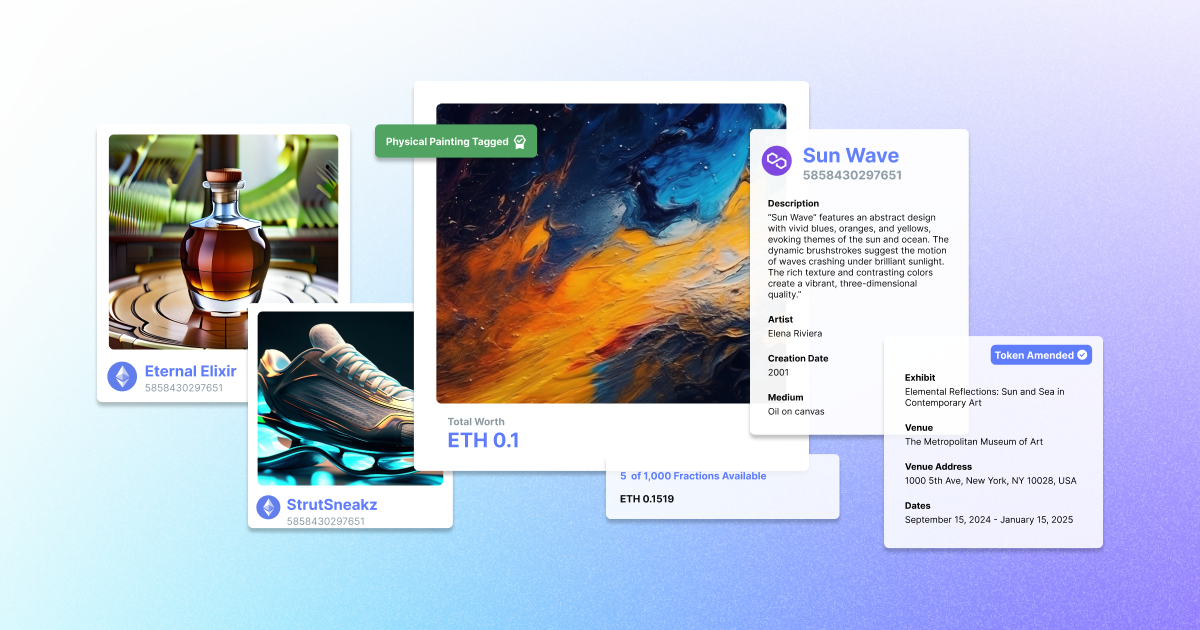

Tokenization is the process of converting physical assets into digital tokens that exist on a blockchain. A token represents ownership or a share in the underlying physical asset. This means that owning a digital token is equivalent to owning a portion of the real-world asset it represents. This is where the power of digital twins comes into play. A digital twin is a virtual replica of a physical asset, ensuring real-time updates on the asset’s status and ownership, as recorded on the blockchain.

The Power of Tokenization in Transforming Markets

The benefits of tokenization extend far beyond simple digitization. By creating a digital twin of an asset, it opens up new opportunities for investors and market participants. Here’s how tokenization is enhancing various industries:

1. Accessibility and Fractional Ownership

One of the most significant advantages of tokenization is the ability to offer fractional ownership. Investors no longer need substantial capital to own a portion of high-value assets. Whether it’s a share in a piece of art or a fraction of real estate, tokenized assets make it easier for anyone to invest in traditionally exclusive markets. NFTs (non-fungible tokens) are a prime example of how fractional ownership works in the art world. Through NFTs, individuals can invest in art pieces, which were previously out of reach for most.

2. Transparency and Security

Blockchain technology ensures that ownership and transaction histories are secure and transparent. Each transaction is recorded on an immutable ledger, preventing fraud and counterfeiting. As a result, tokenized assets are more secure and trustworthy than traditional assets. This transparency enhances confidence among investors and market participants, making asset markets more robust.

3. Liquidity

Tokenization enhances liquidity by enabling 24/7 trading of assets. Digital tokens representing RWAs can be traded in real-time on various platforms, offering enhanced liquidity. This is particularly valuable in markets like art, where it was traditionally difficult to sell pieces quickly. The ability to trade digital assets on a global scale opens up new opportunities for investors.

4. Cost Reduction

Traditional methods of investing in commodities often involve high transaction fees, storage costs, and intermediaries. By eliminating these barriers, tokenization simplifies the process, lowering costs significantly. Whether you’re investing in NFTs or tokenized real estate, the streamlined process ensures greater efficiency and lower overhead.

Real-World Applications of Tokenization

Many industries are already leveraging tokenization to unlock the potential of RWAs including:

1. Real Estate

Fractional ownership through tokenization is transforming the real estate market. By breaking down high-value properties into digital tokens, TokenX allows investors to own a portion of real estate, regardless of their financial status. This approach not only democratizes access to property ownership but also enables faster transactions and clearer ownership records.

2. Precious Metals

Gold and other precious metals are being tokenized, allowing easier trading and fractional ownership. Tokenization ensures the authenticity of these metals by linking each digital token to a physical asset, with its origin and transaction history securely recorded on the blockchain. This transparency helps prevent fraud and guarantees the genuineness of the investment.

3. Art

NFTs have gained significant popularity in the art world. Tokenizing art allows individuals to own fractions of valuable pieces, which were once the domain of a select few. Rather than purchasing the entire work, investors can own a share, opening the art market to a global pool of buyers.

Tokenization not only provides fractional ownership but also ensures the authenticity of the artwork by securely recording its provenance and ownership history on the blockchain. This eliminates concerns over forgery and guarantees that each piece is genuine, offering a secure way to invest in art.

Tokenization represents the future of asset ownership, investment, and transaction. As technologies like blockchain and digital twins continue to evolve, the opportunities for tokenizing assets will expand, opening up new avenues for investors, industries, and global economies. Whether you’re interested in real estate, art, or precious metals, TokenX offers a platform for seamlessly integrating RWAs into the digital world. With increased transparency, security, and accessibility, the digital asset revolution is here to stay.

Want to explore how tokens can work for your business? Contact us and start your journey into the future of digital ownership today.